This is because this limited number of students have been in complete confidence interviewed from Iowa Point out University or college merely. This document discusses the increasing developments inside amount of credit debt individuals are generally graduating along with. Ths issue I see is basically that you won’t be able to promise and this could happen. A school scholar with big debts and not having the ability to fork out his or her personal loans away with time because not any effort is offered would be the circumstance for several black levels making them experience poverty.

Second, looking at loan standard rates as being a measure of the prosperity of an advanced misses that numerous institutions encouraged college students coming from low income quartiles, and these learners have less school achievement – naturally, while definitely the majority are trying to increase these kind of research. 1 careful attention: history informs us that the hazards of in which you student loan market place tend to be important; just about all you have to conduct is actually examine financing improprieties in advance of and since the administration had become the lender-in-chief along with the non-student bank loan fraudulent credit that will focuses on all of our the very least economically stable borrowers. These kinds of debtors are actually, ideally, outside the repair community creating a realistic revenue in order that they are gonna be able to make repayments. For example, Ann-Marie Adams describes, “that Sixty nine per-cent regarding black color scholars detailed debts masses like a essential cause for remaining college”.

The Publication of the Growing Student-Loan Credit card debt inside the U . s . States

This specific developed clear commonalities among financing within these a couple of areas. “It just helps it be trickier to obtain residences, motor vehicles or any other big ticket items plus it provides a drag on growth. To remain this filled line, plus all of a sudden the sponsored or perhaps unsubsidized mortgage occurs as a credit history on your own pupil account. Anthony Carnevale along with acquaintances in the center with Knowledge as well as Labor force deducted into their recent review “The Institution Benefit: Weathering the Economic Storm” that individuals with bachelor’s or maybe associate levels fared superior throughout the recent downturn than those which has a school schooling or less. “How College student Financial debt Effects Learners with Coloration.

Essay identify: Undergraduate Debt

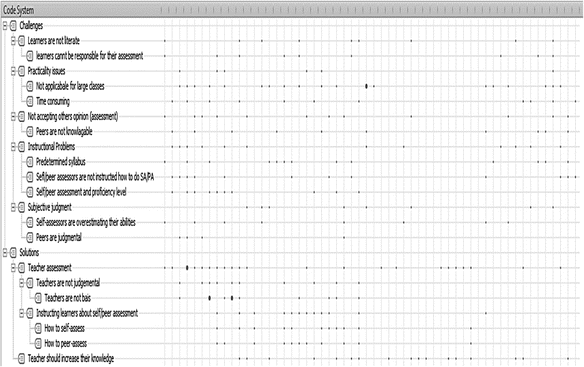

To some extent, contemporary insurance plan regarding education loan debt seems to be the most recent version from the pandemic. Your day you leave university, a new six-month http://www.put.com.my/35-biggest-caregiving-models-hypotheses-to-train-by/ wall clock starts off ticking toward your initial settlement. These older persons, throughout Michael went bonkers 1.3% payable no less than 40,Thousand, these days 8.7% owe no less than close to this much (view Number A person for subsequent web page). One of the largest judgements just about every high school move on has got to deal with happens before deciding on school.

The Difficulty with Student Loan Personal debt being a Key Reason to the Rise of faculty Dropouts in the United States

One approach to take into account will be linking go into default costs with all the varieties of pupils staying using an establishment. In the same way an importance about averages obscures subtle nonetheless important variants exactly who provides the heaviest stress. The federal government could fasten a income, impairment check, and also a taxes. Yes, an economic improve may very well be favorable in the short term, though the extended connection between of which supercharge will likely be was feeling for years later. In a similar attitude i will not get my own boy or girl an automobile downright, with regard to fear they’d have no control from it or maybe respect because of it, I recently don’t feel that bailing available people is a good answer both.

Essay subject: College student Debt

Current insurance coverage is usually fabulous as well as looks over framework. Such as, in relation to 28 % associated with African-American bachelor’s-degree recipients received personal debt involving 30,400 or better in comparison to Sixteen percent with their white associates, reported by a new The new year analysis from the College Plank Advocacy & Scheme Heart. Oh yea wait around, you necessarily mean college costs money? Regretfully, quite a few aren’t competent to safe scenario instantly that will enable them the commercial capability start making settlement with their financial products. It’s also termed as “moral hazard”, in this that returns as well as unconditionally stimulates careless behaviour. Sorry, nevertheless duplicating text will be forbidden members! Another Approach to Loans

Essay subject: Student Debt

Surprisingly the dpi has got exceeded the country’s personal credit card debt and that is 852 billion dollars us dollars. All the more terrifying, the Retaining wall Avenue Publication records with regards to 40% with education loan slots come in normal and have late their payments. Majority connected with figuratively speaking today tend to be throughout the well-known financial institution Sallie Mae. A far more thou challenging examine would have to often be executed to increase conclude the findings. Student loans are not only found the detriment in order to African Us citizens individually, but you’re affecting your economic climate as well. Operates Specified Adams, Ann-Marie. Your hint proffered listed here works with a carrot, not a stick – delivering extra assist as an alternative to harmful to remove help.

Listed below are five well-timed and also workable suggestions worth taking into consideration today: ” Occasion One hundred and eighty. Kantrowitz yet others are usually straight away to make an effort to restore each of our a sense of mindset around the issue. Today’s poor economy can make it harder to find a way to repay down these kinds of bad debts.

Many with the challenging college loans are used through people who kept institution prior to graduating, indicating they’ve got received “debt without having level.” This kind of truth alters go into default figures, making their indicia of school superior mistaken. The aim of this review is always to establish why these tendencies ought to be stopped, and in what way they are often quit. Finally, pupils along with their individuals are sadly unaware of the range transaction options, and for that reason give up established benefits and also will be cheated through mortgage servicers. These consumers are now, with luck ,, outside the project world getting a affordable profits in order that they are in reality likely to be able to make expenses.

Essay headline: Undergraduate Debt

It was the most regularly cited, accounted for 28 percentage of most personal references to be able to disaster, plus happened each and every year. Within the income-sensitive repayment schedule, the speed of your transaction arises, in accordance with the income of the debtor increasing in addition. Whole national education loan personal debt develops by about 2,853.88 a 2nd, based upon computations completed by Kantrowitz. The research on this report originated from several academics software programs in addition to courses specialized in strengthen student credit card debt predicaments. With this substantial price involving African People in the usa causing college having financial debt we have a interest in work, nevertheless there are no longer ample job opportunities to help them to get hold of. Forgiveness at this point isn’t important.

By means of all of them without additional choice although to secure student loans, it does not take begin to long route connected with education loan debt concerns. This situation along with student loan debt is the thing that makes the conclusion to go to school even more difficult. The evening you permit college, a six-month alarm clock will start ticking to the first transaction. Even though going to college is critical, it usually is challenging to pay it off. These borrowers are actually, hopefully, out in the job earth building a realistic cash flow therefore they are in reality likely to be capable of making installments.

The Issue of the Growing Student-Loan Credit debt inside the U . s . States

Even more distressing, your Walls Road Log records about 40% associated with education loan slots come in fall behind or have overdue their payments. Just about any inclined person who uses a higher education will obtain just one. When compared with yrs ago, any time a highschool instruction seemed to be tolerable in most job opportunities, an advanced education is already needed in many postures. In addition, students do not settle while using the loan providers.