The accounts payable days show the number of days it takes an organization to pay suppliers. At the basic level, it only tells the average length of time it takes for a company to pay back its vendors. Additionally, it can help them look for discounts available when they choose to pay vendors sooner rather than later. There are several advantages that come to a company that tracks their average payment period.

What Is Days Payable Outstanding – DPO?

For instance, if you are viewing the annual financial statements but need to be doing a quarterly report, the numbers may be different from one to the next. In our above example, what if you had been doing a quarterly report but used the same numbers from the annual report. If you plugged in 90 days for the days within the period, it would look like Blue ears pays its vendors within 9 days of invoicing instead of the actual 34 days.

Is it better to have a high or low DPO?

- Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser.

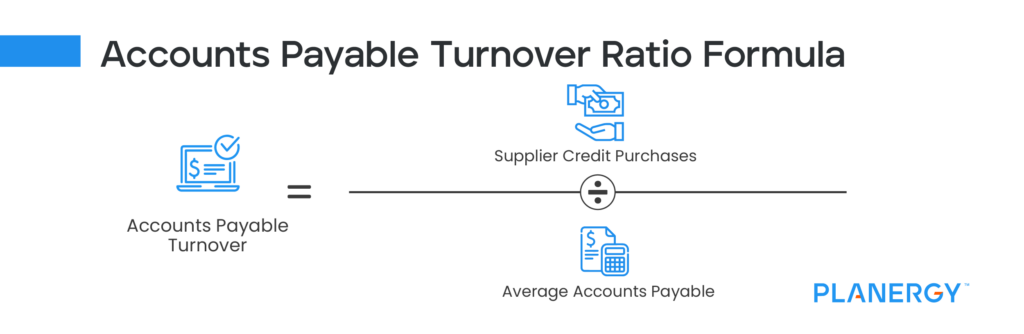

- The ratio shows how many times in a given period (typically 1 year) a company pays its average accounts payable.

- For instance, a company’s relationships with its clients can affect how it manages and collects payments.

- As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows.

- However, the APP doesn’t consider this potential cash flow when determining whether or not the company can afford to pay its debts.

The length of the average payment period is dependent on multiple factors including business policies, liquidity, adequacy of financial planning, and pattern of negotiation with the suppliers. Obviously, if the company does not have adequate cash flows to cover payments at a faster rate, the current average payment period may show the current credit terms are most appropriate. If the industry has an average payment period of 90 days also, for Clothing, Inc., sticking with this plan makes sense. DSO measures the average number of days it takes for a company to receive payment following a sale.

average payment period

It helps key stakeholders and decision-makers identify how quickly the company can pay off its credit purchases and liabilities. If the number is favorable, the company can take advantage of discounts offered by suppliers for a specific time period. It’s a financial metric that measures the average number of days it takes a company to pay its suppliers for goods and services received. The third stage includes the cash the company owes its current suppliers for the inventory and goods it purchases and the period in which it must pay off those obligations. This figure is calculated using the days payable outstanding (DPO), which considers accounts payable.

What Affects the Cash Conversion Cycle?

All of the values for these variables can be found on the company’s financial statements. Company XYZ has beginning accounts payable of $123,000 and ending accounts payable of $136,000. Since 2016, Stenn has powered over $20 billion in financed assets, supported by trusted partners, including Citi Bank, HSBC, and Natixis. Our team of experts specializes in generating agile, tailored financing solutions that help you do business on your terms. Let’s say your company has an Accounts Payable balance of $200,000, a COGS of $1,000,000, and you’re analyzing over a year (365 days). For example, the banking sector relies heavily on receivables because of the loans and mortgages that it offers to consumers.

Definition – What is Average Payment Period?

Assume that Clothing, Inc. can receive a 10% discount for paying within 60 days from one of its main suppliers. The company management team would need to evaluate this to see if there is adequate cash flow to cover the purchase in 60 days. If it can, that could make for a nice increase to the bottom line, as 10% is a huge difference in the clothing industry. Clothing, Inc. is a clothing manufacturer that regularly purchases materials on credit from wholesale textile makers. The company has great sales forecasts, so the management team is trying to formulate a lean plan to retain the most profit from sales. One decision they need to make is to determine if it’s better for the company to extend purchases over the longest available credit terms or to pay as soon as possible at a lower rate.

The accounts payable line item appears in the current liabilities section of the balance sheet and captures a company’s total outstanding balance of unmet payments from past purchases made on credit. The supplier or vendor, as part of their agreement with the customer, already delivered the good or service to the company under the expectation of being paid in cash soon thereafter. Thus, early payments can impede cash flow that could a board member’s guide to nonprofit overhead otherwise be used for investments. However, a low DPO can also show the company is taking advantage of money-saving discounts for early payments and nurturing strong supplier relationships for improved production times. Either way, management must continually gauge AP workflows to determine the reasons for a high or low DPO. AP automation provides financial data in real-time for instant analysis of the full process AP cycle.

The reason for using the average balance, rather than the ending balance, is to ensure consistency in the timing of the ratio. Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. On the contrary, if the business is more focused on creditworthiness, it may raise more finance and incur interest charges. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

In addition to being limited to only credit sales, net credit sales exclude residual transactions that impact and often reduce sales amounts. This includes any discounts awarded to customers, product recalls or returns, or items re-issued under warranty. This metric should exclude cash sales (as those are not made on credit and therefore do not have a collection period). These ratios can be known as activity ratios, efficiency ratios, cash ratios or working capital ratios and can also be included under the liquidity heading. The average A/P days among mature companies operating in the same industry as our company is 100 days, which we’ll use as our final year assumption. Most of the time, businesses track APP annually, giving the formula a value of 365 days.

On the other hand, too little inventory can result in production stoppages and dissatisfied customers. Days Payable Outstanding, or DPO, is one of several metrics used to gauge the financial health of a company. In short, it measures about how many days it takes the company to pay its obligations. Large companies with a strong power of negotiation are able to contract for better terms with suppliers and creditors, effectively producing lower DPO figures than they would have otherwise. To manufacture a salable product, a company needs raw material, utilities, and other resources. In terms of accounting practices, the accounts payable represents how much money the company owes to its supplier(s) for purchases made on credit.

A higher DPO generally means the company takes longer to pay its bills, allowing it to retain cash. Software companies that offer computer programs through licensing, for instance, can realize sales without the need to manage stock. Similarly, insurance or brokerage companies don’t buy items wholesale for retail, so CCC doesn’t apply to them. To better illustrate the impact of the average payment period on the health of a business, let’s look at some real-world examples. Another essential component to understanding and improving your average payment period is the concept of Days Sales Outstanding or DSO.

No Comments