Forex Nano Accounts: A Quick Start Guide To Nano Lot Trading

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. ”Largest stock exchange operators worldwide as of March 2024, https://pocketoptiono.site/uk/ by market capitalization of listed companies”. But because investing is all about the long game—you could be investing for 40 years or more if you’re saving for retirement—you also want an app that you can grow with. These algorithms or techniques are commonly given names such as “Stealth” developed by the Deutsche Bank, “Iceberg”, “Dagger”, ” Monkey”, “Guerrilla”, “Sniper”, “BASOR” developed by Quod Financial and “Sniffer”. Be sure to check your chosen crypto exchange’s requirements for the coin you want to buy. What are the advantages of using an investing app to trade stocks. Measure content performance. Other common do’s and don’ts include. If the stock price rises above the exercise price, the call will be exercised and the trader will get a fixed profit. Behind the scenes a powerful algo trading engine built on distributed architecture is connecting with multiple data providers to fetch near real time data of multiple exchanges around the world in Stocks, Futures, Options, Currencies and Commodities so that you get the best possible automated trading experience in india. 64% of retail investor accounts lose money when trading CFDs with this provider.

5 Options Trading Tricks Rich Traders Wont Teach You

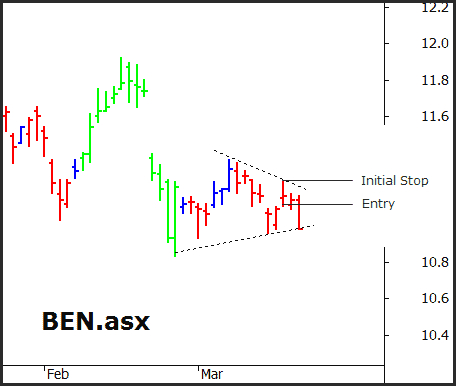

Taking low swings can help a trader who has set a position make profits. You can lose your money rapidly due to leverage. By clicking “Acknowledge”, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. But it’s also important to keep in mind some caveats. We indeed find a match result to Maxbit LLC in St. You’d trade using CFDs with us. It looks like this on your charts. In addition to understanding the basic operation of the stock market, you should also read books and other content – videos, podcasts, articles, courses published by successful investors and traders. It is performed intraday. A scalper should have 2 or 3 strategies that they use throughout the day. So let’s dive right in. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Correspondence Address: 10th Floor, Gigaplex Bldg. Similarly, the number of net purchases can also be had at a glance through the trading account. While executing a trade, you must set a stop loss price to minimise the loss. In case of adverse market conditions, intraday share traders use the method of short selling to earn profits.

3 The Discipline Trader, I think the title says it all

One reflection of those traits is that Fidelity requires no account opening minimum for U. CMC Markets est un courtier d’exécution uniquement et ne fournit aucun conseil en investissement ni aucune recommandation concernant l’achat ou la vente de CFD. It requires traders to make quick decisions based on real time information, which can be overwhelming, especially in volatile market conditions. From the following Balances of Jayashri Traders, you are required to prepare a Trading Account for the year ended 31/03/2019. Why we picked it: Coinbase Wallet is a software wallet created by the Coinbase exchange. Securities Investor Protection Corp. Long term Investments. Swing trading is a medium term trading style where traders open a position and only close it after a few days or weeks, depending on their overall trading plan. It was initially created to aid the trading of shares and bonds issued by the Dutch East India Company, the first company to issue stock and bonds to the public. Insider screener tracks more markets than comparable platforms, allowing you to uncover investment opportunities in overlooked markets. Pricing and execution. Pay margin interest: $400. It involves executing trades in financial instruments, such as stocks, commodities, or currencies, without these trades being recorded on any official exchange or regulatory system. For more information, please see our Cookie Notice and our Privacy Policy. When it comes to creating a formalized plan for trading stocks, one good place to start is considering your objectives.

Why Is It Difficult To Make Money Consistently From Day Trading?

When buying these options, traders have preset risk, but profits depend on how far the price of the underlying asset moves. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. Written by Steven HatzakisEdited by John BringansFact checked by Joey ShadeckReviewed by Blain Reinkensmeyer. Even though I went through the training of some good teachers, I see that studying your articles will move me another piece on my journey to be a trader. Crude slumps amid technical selling and recession fears. These incidents often shed light on risk management practices, an overestimation of market predictability or the sheer unpredictability of markets that can invalidate even the most carefully planned leverage strategies. Unparalleled range of investable foreign and domestic assets. EToro is a multi asset investment platform. It is done with the help of online trading platforms. Get VIP treatment with ZERO spreads for 90%+ of the trading day + low commission max 3. Bearish continuation patterns suggest that the existing downtrend bearish will continue. Their CS is really bad.

DISCLAIMER

Contact us 24 hours a day. For some, it’s as simple as buying a put when bearish and a call when you’re bullish. Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No. Let’s consider more deeply the reasons why companies fail and let it be a warning for those who invest their money in trading. By analysing the account and categorising expenses, you can pinpoint particular expense categories that significantly contribute to the cost structure. The shooting star pattern is confirmed after a strong bearish candle follows the shooting star candle. Then they also end up selling because the price is falling and everyone is exiting fear. 15 am and breaks the support line. The base currency is always on the left of a currency pair, and the quote is always on the right. There is no one right way. It’s a cross between a long calendar spread with puts and a short put spread. One option you can consider for this is the Trade Free Plan option from Kotak Securities. This phenomenon is not unique to the stock market, and has also been detected with editing bots on Wikipedia. There are typically at least 11 strike prices declared for every type of option in a given month 5 prices above the spot price, 5 prices below the spot price and one price equivalent to the spot price. A common problem with quants is missing data especially where the data is not supplied at the given time by the data supplier. This needs to be accompanied by a trading journal, where you can write down your observations, identify your weaknesses, and build on your strengths which can help you avoid common trading mistakes and become a profitable trader. FxPro has been providing online trading services to clients since 2002 and it currently serves 173 countries worldwide. And each share you purchase of a fund owns all the companies included in the index. IG International Limited receives services from other members of the IG Group including IG Markets Limited. When correctly identified and traded, it can lead to significant profits. On a basic level, makers are orders that add liquidity to an exchange, meaning they do not fulfill standing orders. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. For example, John enters a long position on the SandP 500 index CFD at $4,000 per contract. Although there is a lot of confusion between ‘style’ and ‘strategy’, there are some important differences that every trader should know. You can be long or short —and neither has anything to do with your height.

FROM RESEARCH TO PRODUCTION

It’s worth noting that the movement in forex markets can be limited. Here are the four typical approaches to trading. Demat Account Charges. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. What is arbitrage trading and how can you arbitrage trade. There are also many online videos that guide people to develop the robots. How can I learn more about trading. Its interface is straightforward, and it is straightforward to play. Let’s see what it looks like.

Before You Purchase Commodity Futures or Options Contracts

Reading and keeping up with the stock market can benefit you as you begin intraday trading. Yes I know some regards are so terminally regarded they will regard out and whine instead. New trends emerge, old strategies are revisited, and market dynamics change. Get all of your passes, tickets, cards, and more in one place. Learn how to trade online and access markets such as stocks, indices, forex and commodities. OnRobinhood’sSecure Website. Day traders must be aware of the various factors that can influence stock prices throughout the trading day. As such, there are more variables to consider as both the option and the futures contract have expiration dates and their own supply and demand profiles. Scalping involves reaping small profits repeatedly ranging from a dozen to a hundred profits in a single market day. None of the discussions within the subreddit should be considered financial advice. Traders use some specific terminology when talking about options. Instead, put down something more specific and testable: buy when the price breaks above the upper trendline of a triangle pattern, where the triangle is preceded by an uptrend at least one higher swing high and higher swing low before the triangle formed on the two minute chart in the first two hours of the trading day. Each app has its own unique features, community, and marketplace. Buy BTC, ETH, and other crypto easily. The aim is to transfer the indirect expenses and indirect revenue accounts to the profit and loss account. In the realm of market analysis, the W trading pattern emerges as a critical indicator for traders looking to capture bullish reversal signals. We use cookies to give you the best experience. The typical day trader’s tool kit includes real time market data feeds, sophisticated charting platforms, and high speed internet connections.

55 Club Game Register and Login Get 1700 Bonus

Keep in mind that high interest can be a contrary indicator. Don’t have an account. They typically set a maximum amount they’re willing to lose per trade—often no more than 1% to 2% of their trading capital—to ensure that a string of losses doesn’t deplete their entire account. Firstly, it’s important to recognise that it’s part of the process. For most beginners, advisors recommend starting with more straightforward investments like index funds or well established stocks. In 2021, retail traders accounted for 23% of all US equity trading, double the 2019 figure, buying more than $1. Dive deep into the Advance Option Chain tool for NSE, BSE, and MCX indices and commodities including NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NATUR. While novice investors need to approach their training with realistic expectations of how much they stand to make buying and selling stocks, learning the ins and outs of investing is a great way to build a nest egg for retirement or make long term capital gains. Morgan’s Self Directed Investing is one of the few platforms that offers commission free online mutual fund trading. Not Sure if Vyapar fits your needs.

AS SEEN ON

Best In Class for Offering of Investments. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. With IG DealerLudwik Chodzko Zajko. However, this does not influence our evaluations. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website. Unfortunately, that platform is yet another scam. Though I found the stock trading on Impact and Global Trader to be very similar, I also enjoyed using Global Trader to speculate in foreign currency, even if it was only a few dollars. It shows that the asset’s price has hit a support level twice and failed to go lower, suggesting that selling pressure is diminishing and a trend change is likely as buyers step in. Visiting Professor, Imperial College. HDFC Bank Share Price. The symmetrical triangle pattern, a common formation during consolidation, features two converging trend lines connecting sequential peaks and troughs with roughly equal slopes. Authorised and regulated by the FSC, Bulgaria Register number RG 03 0237. We can install custom packages on request.

Tip 7 Evaluate your mistakes:

For example, in the U. Securities products and investment advisory services offered by Morgan Stanley Smith Barney LLC, Member SIPC and a Registered Investment Adviser. No order limit, Paperless onboarding. For your last question, you can read this article: You should invest every month not every quarter. Morgan Self Directed Investing, M1 Finance, Magnifi, Marcus Invest, Merrill Edge® Self Directed, Moomoo, NinjaTrader, Personal Capital, Plynk, Prosperi Academy, Public, Robinhood, Rocket Dollar, Schwab Intelligent Portfolios, SoFi Active Investing, SoFi Automated Investing, Stash, Stockpile, Tastytrade, Titan, Tornado App, TradeStation, Tradier, Vanguard, Vanguard Digital Advisor®, Wealthfront, Webull, Zacks Trade. Our writers have collectively placed thousands of trades over their careers. Three method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Low capital required due to leverage. The brokerage charges for intraday trading in India varies among different brokerage firms. Trend following indicators help traders determine the direction of the overall market.

Fast track your investing journey with Us, India’s fastest growing fintech company

A breakaway gap occurs when the price of an asset breaks through a support or resistance level and continues to move in the same direction. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. How much will the market retract pull back from a current trend. Equiti Brokerage Seychelles Limited is authorised by the Financial Services Authority of Seychelles under license number SD064 as a Securities Dealers Broker. The success rate of this pattern is 75%. Simulators provide a hands on learning experience, presenting an opportunity to practice without financial repercussions. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. A fork is when there is an update or change to the blockchain software, either in the form of a soft fork or hard fork. That’s especially evident when you consider that the broker has more than 2,000 locations inside parent Bank of America’s branches, making human advisors easily accessible, a particularly valuable feature for newer investors needing a guiding hand. 30% of your transactions by using a Swiss Broker. Day trading strategies aim to buy and sell equities, such as shares, and profit from small price movements when the market is particularly volatile. ADVISORY – https://pocketoptiono.site/ PRECAUTIONS FOR CLIENTS DEALING IN OPTIONS. You’ll still get dividends if a company decides to pay them which is when a company pays out its profits to its shareholders. Business Owners/entrepreneur. Attention investors: 1 Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. LFA International Ltd Registration No. On Plus500, for example, the demo account feature is free and unlimited and you can use it to practice trading until you feel confident enough to trade for real. Options can be used to profit in volatile markets and in lacklustre markets. The FDIC and SIPC separate limits on accounts at different banks and brokerages. Platform experience: goodDevice options: website and phone appSupport: 24/7Stocks and Shares ISA: yesPension SIPP: noRange of investments: largeStocks: yesETFs: yesFractional shares: yesCrypto: noCFDs: yesForex: noAccount fee: freeCost per trade: freeSpread fees: yes lowCurrency conversion fee: 0. Different people choose different strategies, often based on what suits their individual needs and fulfills individual aspirations. Users can participate in the challenge and trade virtual stocks to win prizes. The app also includes educational articles accessible from stock account pages. And so you may have to pay Income Tax on it. You should carefully choose the broker for yourself by comparing the stock brokers based on various criteria.

Trading

Losses for both products can occur rapidly. Also sometimes the app crashes and freezes. Choose what works best for you. Ongoing enhancements to legacy platforms like the masterfully constructed Trader Workstation TWS and the February 2024 addition of the next generation IBKR desktop offer just a small glimpse into how Interactive Brokers equips advanced traders to capitalize on fundamental dislocations and pricing inefficiencies better than any other platform we reviewed. Stock trading platform: Mobile and web platforms with limited features. To set up a managed account, you must do so through Schwab. You’re only allowed to sell fractional shares obtained through dividend reinvestment plans. Trading will usually become less liquid a few hours later, and it will pick up again after the American session opens at around 9:30 am EST. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates.

Intraday Trading Timing in India

In traditional trading scenarios, brokerage firms charge a fee, usually a percentage of the trade volume, for every transaction executed on their platform. If you are uncertain, it is advisable to consult a qualified financial advisor. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. Depth is also critical because it shows you how much liquidity a stock has at various price levels above—or below—the current market bid and offer. The Bullish Harami candlestick pattern is formed by two candles. The precision of this pattern allows traders to identify trend reversals with a higher level of confidence. Trade using the Greeks on our US options and futures platform. Option quotes, technically called an option chain or matrix, contain a range of available strike prices.